IPV Industry Survey 2022: Setting the course for our industry

News General news

"For many reasons, 2022 is a year of fundamental course-setting and change," sums up Karsten Hunger, Managing Director of the Paper and Film Packaging Industry Association: Ukraine war, difficulties in raw material supply, exploding energy costs, shortage of skilled workers and the conversion of products to both renewable raw materials and better recyclability, the list of defining buzzwords in this year's industry survey is long. "It is all the more remarkable how stable and positive the companies are in facing these tasks," adds Hunger. The industry is in a robust position. Although the construction sites for the companies are very large and, above all, diverse - and, for example, more than 87 percent of the companies fear further high prices and rising costs on the raw material markets for paper and plastics - 60 percent of the member companies still believe that business in 2022 will be the same or (even) better than in the previous year. This reflects a similarly positive mood as in 2021 despite the additional burden of war and the energy crisis.

Raw materials can no longer be calculated in the medium term

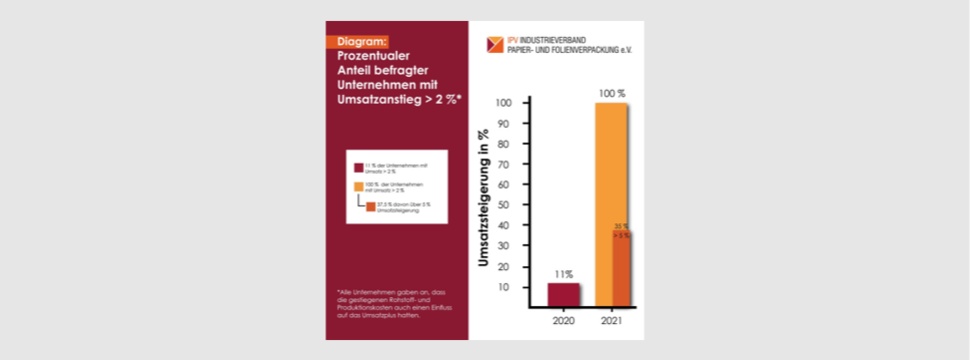

This is already the second survey this year for the IPV. After an unscheduled Ukraine flash survey in April, the focus was now on the overall view of the 2022 business year and the assessment of the past year. What stands out is the growing turnover development at more than 75 percent of the companies. The obvious and at the same time sobering answer behind this is simply that raw material and production costs have increased significantly and have caused turnover to rise artificially. However, 75 per cent have also achieved a better return in the past year than in the previous year (more than two per cent). That is 20 percent more than in the previous year. The companies are currently working at full capacity.

Shortage of skilled workers remains, unclear picture for investment propensity

The Covid 19 pandemic has, of course, had a major impact on the past business year. Many customers increased their order volume to safeguard against possible delivery shortfalls. But one thing is also clear. The Corona pandemic currently seems a long way off. New problems are already overlaying these memories. Above all, the procurement of raw materials and trade goods has become even more difficult in 2022 and simply cannot be calculated in advance. Many companies already only work with current offers and no longer make framework agreements at all. Even price lists now have a quick expiry date. The stockpiling of raw materials has already been systematically expanded in many companies.

There are positive reports from the member companies of the association in the area of personnel. Not a single company reported a significant decrease in the number of employees to the IPV. But 75 percent of the companies are working with the same number of employees as in 2021. 25 percent were able to report an increase in the number of employees. A look at investment performance paints an unclear picture. After all, almost 40 percent have increased their own investment performance for 2022, which is almost 15 percent more than last year. But the same number of companies also cut back on investment. "You can see that our industries are exactly at the crossroads between spending for the future and spending for the present. The development of the markets gives arguments for both attitudes," says IPV Chairman Klaus Jahn. But one truth is also that many companies had already invested extensively in the past years. Klaus Jahn is particularly pained by the issue of a shortage of skilled workers: "We have a future-proof industry with a very good order situation, but every second company now complains about a lack of employees to operate its machines properly in order to produce successfully."

Focus on environmental protection and plastic alternatives

The conversion of products has already started several years ago with research into better recyclability and the switch to renewable raw materials. Almost 70 percent feel the demand or pressure from customers for fibre-based products as a substitute for plastic-based packaging. Three out of four companies still complain about the negative public image of plastics. However, the trend towards fibre-based products has been going on for several years now and is becoming more firmly established. And the packaging industry is naturally reacting to this. The number of companies that are critical of littering is even greater. Again and again, manufacturers are held responsible when consumers improperly dispose of packaging in the environment instead of recycling it. Yet Germany has a comprehensive and very well functioning recycling system that is recognised worldwide.

In the political part of the industry survey, the companies give an outlook on the politics of the day. They are sceptical about the governing traffic light coalition. The majority of companies fear that it will make their work more difficult. Among other things, they fear interference in the autonomy of collective bargaining and the threat of environmental protection measures that will have a direct and one-sided effect on the packaging industry. "Our members are also demanding as a political agenda that we continue to push for the removal of EU subsidies for Eastern European competitors, this distorts competition. The framework conditions in the EU must be equal," says Karsten Hunger. "In addition, we are also fighting on a broad front nationally for the preservation of the competitiveness of our regionally strongly anchored industry. And if I may add: the long demanded reduction of bureaucracy must finally become noticeable. The statistical and regulatory effort that has to be made as a company in the packaging industry has increased rather than decreased."