bvdm Economic Telegram October 2022: Business Climate Remains Weak

News General news

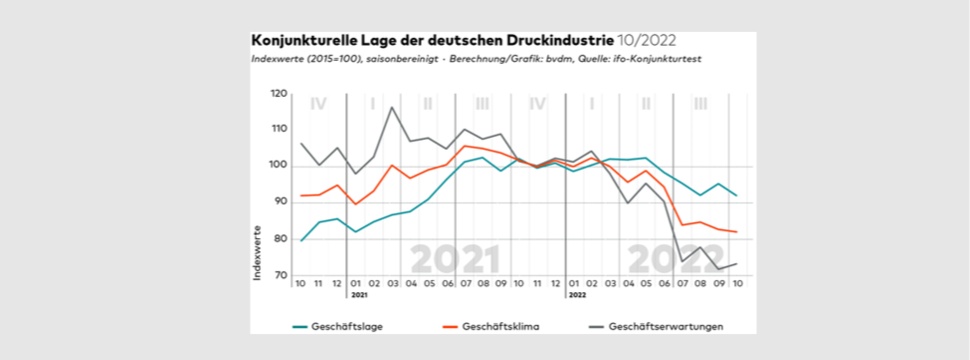

The business climate in the German print and media industry continued to decline in October. The business climate index calculated by the German Printing and Media Industries Federation fell by a seasonally adjusted 0.8 percent compared with the previous month. At 82.0 points, the index was around 19.4 percent below its level for the previous year. The mixed order situation and an associated decline in capacity utilization caused problems for companies in October, while the business outlook remains predominantly pessimistic due to the uncertainties surrounding economic development and the level and predictability of future energy prices.

In October, the decision-makers at printing and media companies surveyed by the ifo Institute assessed their current business situation as worse than in the previous month. However, their expectations for business development over the next six months increased somewhat and are therefore less pessimistic than in the previous month. Overall, however, the values for the business climate decreased slightly. The characteristics of the current and expected business situation determine the development of the business climate, which is a good leading indicator for the production development of the print and media industry.

After recovering somewhat in September, the seasonally adjusted business situation index lost around 3.5 percent in October compared with the previous month. The index stood at 92.0 points, the same level as in August 2022, and lost around 10 percent year-on-year. However, a year-on-year increase of 4.9 percent can still be observed for the cumulative average values for 2022. Companies in the print and media industry are particularly troubled by the continuing high production constraints, 90 percent of all company managers surveyed complained about restrictions on production. The biggest obstacles are a lack of orders (53 percent), a shortage of skilled workers (49 percent) and a shortage of materials (48 percent). The lack of orders in particular is increasingly a problem against the backdrop of the current tense economic environment. Although the average range of the order backlog fell only slightly year-on-year from 2.3 months to 2.0 months, capacity utilization fell from an average of 85.5 percent to 79.9 percent compared with October 2021. In addition, only about 12.7 percent of respondents said their production activity had increased recently in October. Some 33.9 percent of respondents registered a decline in production activity. Consequently, the balance was clearly in negative territory.

The expectations of companies in the print and media industry continue to be shaped by developments on the procurement markets and in the overall economy. Uncertainties and high volatility in electricity and gas prices, as well as persistently high printing paper prices, are keeping business expectations at a low level. In addition, the utility contracts for energy at numerous companies expire at the end of the year. It is therefore to be expected that the high costs will increasingly impact on the business situation. In addition, the lack of clarity regarding the concrete implementation of the gas and electricity price brakes means that it is only possible to make limited calculations, which makes it difficult for companies to plan ahead. planning horizon of the companies. However, the overall outlook was slightly less pessimistic than in September. The business expectations index rose by around 2.1 percent in October compared with September. At 73.2 points, it is also 27.9 percent below the previous year's level. This means that around 59.7 percent of respondents in the print and media industry expect the business situation to deteriorate further over the next six months.