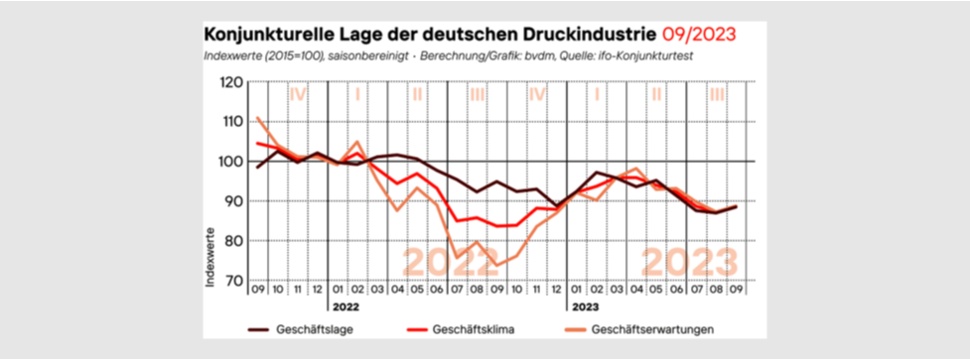

bvdm business cycle telegram September 2023 - Business climate stabilises at a low level

News General news

In September 2023 the seasonally and calendar-adjusted business climate in the German print and media industry stabilised somewhat. Both the business situation assessment and the business expectations regarding the next 6 months were slightly positive compared to the previous month. The business climate index calculated by the Bundesverband Druck und Medien (bvdm) rose by 1.7 per cent compared to August after seasonal and calendar adjustments. At 88.8 points the index was around 5.9 per cent above its year-earlier level. However, the persistent weakness in orders as well as a deterioration in the earnings situation ensure that the assessments of print and media entrepreneurs remain predominantly pessimistic despite slight gains in September.

In September 2023 the decision-makers at print and media companies surveyed by the ifo Institute assessed their current business situation slightly better than in the previous month. Expectations regarding business development over the next six months also rose in line with this. The values for the business climate are therefore up on the previous month. The characteristics of the current and expected business situation determine the development of the business climate, which is a good leading indicator for the production development of the print and media industry.

The seasonally and calendar-adjusted business situation index broke the negative trend of the last three months in September and at 88.7 points was around 1.7 percent above the previous month's value. However, the index was still around 6.7 percent below the corresponding level of the previous year. 53 percent of the business leaders surveyed assessed their company's current business situation as neutral in September. About 16 percent assessed the situation positively, while about 31 percent took a negative position. With a value of around -16 percentage points, the balance remained in negative territory and around 13 percentage points below the previous year's value. The assessments of businesses in September were shaped by the continuing low order backlogs and a deterioration in the earnings situation. Overall, 56 percent of the respondents assessed their order situation in September as too low, while 42 percent gave it a neutral rating. At around -55 percentage points, the balance remained well into negative territory, some 18 percentage points below the figures for the same month last year but around 7 percentage points above the low for the year recorded in July 2023. The earnings situation of print and media companies is also weighing heavily. With a balance of -36 percentage points, the respondents assess their current earnings situation significantly worse than in the same month of the previous year (-24 percentage points), thus burdening the business situation of the companies.

The expectations of companies in the print and media industry regarding the future business situation also rose slightly in September. At a seasonally adjusted 89.0 points, the index was around 1.7 per cent above the previous month's level. However, only a small number of companies (10 per cent) stated that they expected a significant improvement in their business situation in the next six months. An overwhelming share of respondents (53 percent) expected their business situation to remain unchanged, while about 37 percent expected it to worsen. Moreover, the outlook for overall economic development gives little reason to assume positive growth impulses and thus does not suggest a fundamental improvement in the order situation. About 59 percent of the enterprises expect production activity to remain the same within the next three months, while 26 percent expect production figures to decline. The cost situation of the companies also remains tense in perspective and is likely to put further pressure on the profit margins of the companies in a market characterised by strong competition and overcapacities. In view of this situation, expectations for future employment development worsened and reached a new low for the year with a balance of -29.5 percentage points.