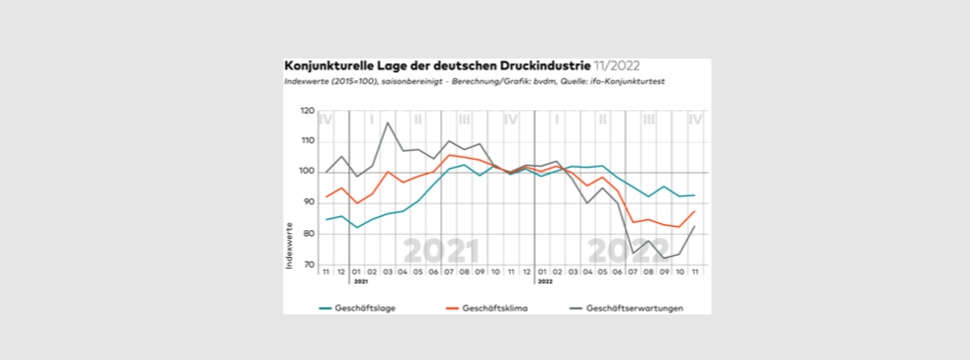

bvdm Business Telegram November 2022: Current business climate better than in October; companies less pessimistic about the future

News General news

After reaching a historic low in October, the business climate in the German print and media industry turned sharply upward in November. The business climate index calculated by the Bundesverband Druck und Medien (German Printing and Media Industries Federation) rose by a seasonally adjusted 6.2 percent compared with the previous month. However, at 87.4 points, the index was around 7.7 percent below its level for the previous year. The relief announced and cautious assessments regarding a less severe recessionary economic trend mean that companies' business expectations in particular are significantly less pessimistic.

In November, the decision-makers at printing and media companies surveyed by the ifo Institute assessed their current business situation as slightly better than in the previous month. At the same time, their expectations for business development over the next six months were significantly less pessimistic than in the previous month. The values for the business climate therefore increased significantly. The characteristics of the current and expected business situation determine the development of the business climate, which is a good leading indicator for the production development of the print and media industry.

After declining in October, the seasonally adjusted business situation index rose by around 0.3 percent in August compared with the previous month. The index stood at 92.6 points, just above the seasonally adjusted lowest level of the current year. For the cumulative values of 2022, a year-on-year increase of 3.8 percent can be observed. The persistently high prices for intermediate goods continue to cause problems for companies in the print and media sector and have a particularly negative impact on the generation of new orders via high selling prices. Order backlogs for the traditionally strong fourth quarter also lag behind the figures for crisis-free years. Accordingly, 55.9 percent of respondents rated the current order backlog as "too low". 36.0 percent rated the order situation as unchanged and only around 8.1 percent as positive.

The expectations of companies in the print and media sector continue to be shaped by expected developments on the procurement markets and the overall economy. These improved slightly - partly as a result of the partial easing of tensions on the energy markets and the price brakes announced by the German government for electricity and gas. Some signs also point to a flattening of paper prices. The business expectations index rose by 12.4 percent in November compared with October and is now at its highest level since June 2022. However, this should not obscure the fact that the business outlook for the next 6 months remains generally pessimistic. At 82.5 points, the index remains around 17.6 percent below the previous year's level. Around 55 percent of respondents in the print and media industry expect the business situation to deteriorate further in the next six months. 44 percent expect the business situation to remain unchanged, while 1 percent anticipate an improvement.