bvdm Economic Telegram April 2021: Upward Trend in Business Climate Index Ended for the Time Being

News General news

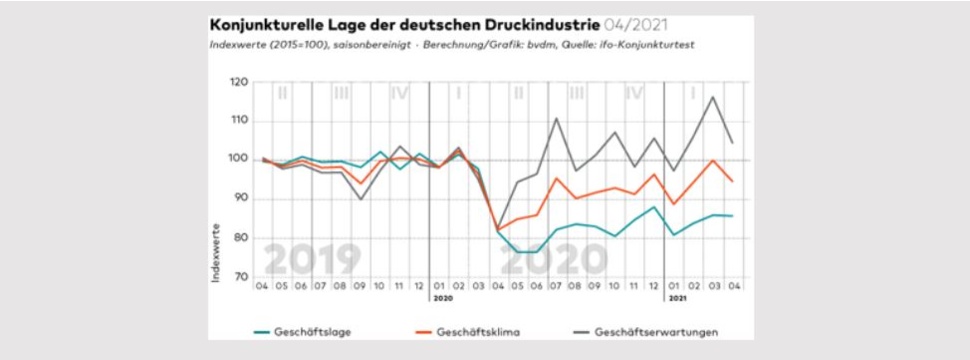

After brightening considerably over the past two months, the business climate in the German print and media industry cooled off again in April. The business climate index calculated by the German Printing and Media Industries Federation fell by a seasonally adjusted 5.3 percent compared to the previous month. However, at 94.6 points, the index stands at 15.3 percent, well above its year-earlier level. However, this sharp rise is mainly due to a statistical base effect - in April 2020, the index had fallen to a historic low due to corona, so that the year-on-year comparison now appears particularly high.

In April, the printing and media companies surveyed by the ifo Institute assessed their business situation as similar to March. However, their expectations for future business development were more pessimistic than in the previous month. The values of the current and expected business situation determine the development of the business climate, which is a good leading indicator for the production development of the print and media industry.

After the seasonally adjusted business situation index had risen in February and March, it virtually stagnated at the previous month's level in April at 85.7 points - the drop was just 0.3 percent. This was the first time since the outbreak of the Corona crisis that the index had been above its prior-year level - the increase was 5.0 percent. The central reason for this year-on-year increase is a statistical base effect. In April 2020, the index had plunged to a historic low due to the corona crisis, so the current year-on-year comparison is now very positive. This base effect also explains the high increase in capacity utilization, which rose by 6.5 percentage points year-on-year to 74.8 percent. However, it is still well below the long-term average of 82.2 percent. In addition to the shortage of orders, bottlenecks in the supply of input products are also currently affecting production. In April, for example, 25 percent of companies affected by production constraints complained of material shortages - the highest figure since 2010.

The fact that the business climate clouded over despite the stable business situation is due to the fact that print and media companies assessed their expected business situation for the next six months as weaker than in the previous month. In April, the seasonally adjusted index of business expectations fell by 10.2 percent to 104.5 points, giving back all the growth from March. After the index had made significant gains in the last two months, business leaders revised their expectations downward again in April. The central reason for this correction is the currently again very dynamic infection situation, which is dampening the hopes that have recently arisen for an early economic recovery. In April, for example, 92 percent of all respondents stated that their current production capacity is sufficient to manufacture existing orders as well as those expected for the next 12 months. The fact that an exceptionally strong year-on-year index increase of 26.6 percent was registered despite this previous month's decline is also due in this case to the statistical base effect.