bvdm economic telegram July 2022: High energy prices and possible gas supply freeze cause expectations to plummet and fuel fears of recession; business climate slumps.

News General news

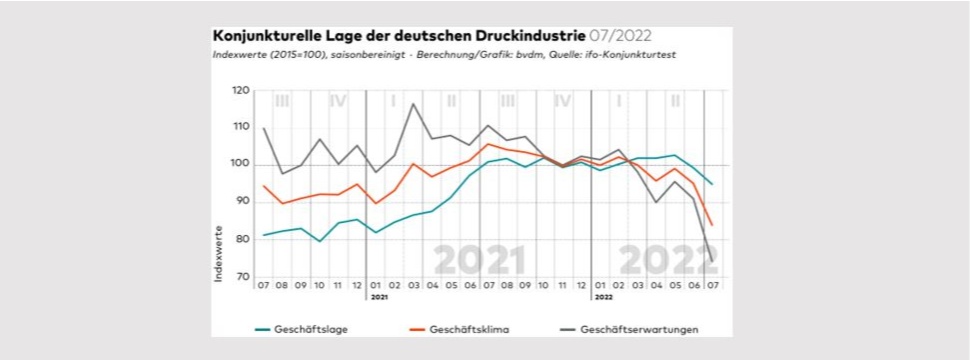

Having already declined in June, the business climate in the German print and media industry slumped in July. The business climate index calculated by the Bundesverband Druck und Medien (German Printing and Media Industries Federation) fell by a seasonally adjusted 11.8 per cent compared to the previous month to the level of April. The index stood at 83.9 points, some 20.6 per cent below its year-earlier level. Persistently high inflation, high energy prices and the possibility of a complete cut-off of gas supplies from Russia are clearly clouding business expectations and fuelling concerns about a recession.

In July decision-makers at print and media companies surveyed by the ifo Institute assessed both their current business situation and their expectations for business development over the next six months as significantly worse than in the previous month. The values for the business climate therefore declined drastically. The values of the current and expected business situation determine the development of the business climate, which is a good leading indicator for the production development of the print and media industry.

After already declining in June, the seasonally adjusted business situation index lost 4.5 per cent in July compared to the previous month. The index stood at 94.9 points, its lowest seasonally adjusted level since May 2021 and the first time this year that the index is 6.0 per cent below its year-earlier level but still 0.5 per cent above the previous year's average. High energy prices and inflation continue to hamper consumer sentiment and thus worsen the order situation in the sector. About 40 percent of all companies surveyed complain about low order backlogs and report falling production values in the previous month. In addition, 84 percent say they are affected by production constraints. The shortage of materials (62 percent), followed by a shortage of skilled workers (48 percent) and a lack of orders (44 percent) are the biggest obstacles to production.

Business expectations were drastically affected by speculation about a gas supply stop from Russia and thus an impending gas shortage. The business expectations index fell by 18.5 per cent in July compared to June and is thus even around 10 percentage points below the Corona low of April 2020. At 74.1 points, it is also 33.0 per cent below the previous year's level. However, this should be assessed in the context of the statistical basis. Due to the good values of the same month last year, the year-on-year comparison is thus particularly high. Some 49 per cent of respondents in the print and media industry expect the business situation to deteriorate further over the next six months. 49 per cent expect the business situation to remain unchanged, while only 2 per cent anticipate an improvement. Besides the strains on supply chains, energy and gas prices continue to be a cause for concern. Due to high inflation, increased costs and the threat of recession, it is feared that falling demand will continue to lead to a decline in orders and falling sales. Moreover, the print and media industry is doubly affected in the event of a gas shortage. On the one hand, the gas used in the production process is difficult to substitute, depending on the type of production, and on the other hand the supply of graphic papers to the printing industry is not fully guaranteed in the event of a gas emergency.