bvdm economic telegram July 2023 - Business climate declines significantly at the beginning of the second half of the year

News General news

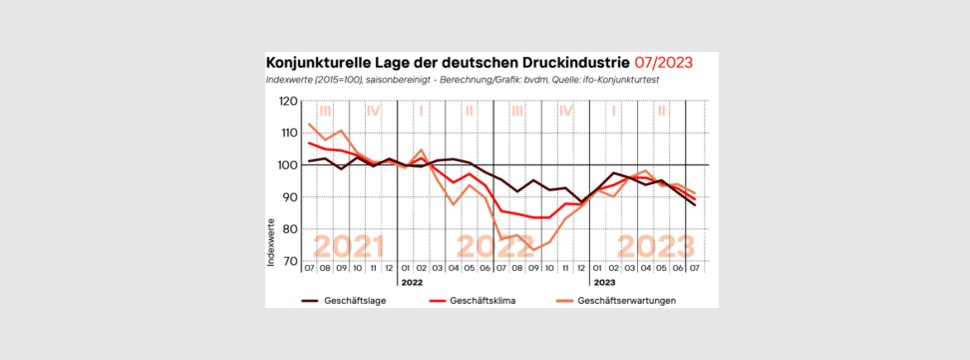

In July 2023 the seasonally and calendar-adjusted business climate in the German print and media industry declined. In addition to the negative trend in the business situation assessment, business expectations also turned sharply negative in July. The business climate index calculated by the Bundesverband Druck- und Medien (German Printing and Media Industries Federation) fell by 3.7 per cent compared to the previous month, adjusted for seasonal and calendar effects. At 89.5 points, the index was around 4.3 per cent above the previous year's level.

In July 2023 the decision-makers at printing and media companies surveyed by the ifo Institute again assessed their current business situation as worse than in the previous month. In line with this, expectations regarding business development over the next six months also declined further. The values for the business climate therefore fell significantly compared to the previous month. The business climate, which is a good leading indicator for the production trend in the print and media industry, is determined by the current and expected business situation.

The seasonally and calendar-adjusted business situation index fell for the second month in a row and stood at 87.7 points, around 4.3 percent below the previous month's value. The index is thus around 8.2 percent below the corresponding level of the previous year and at the same time reached its lowest level since the end of the last Coronalockdown in 2021. 49 percent of the business leaders surveyed assessed their company's current business situation as neutral in July. Some 13 per cent assessed the situation positively, while around 38 per cent took a negative stance. When asked about obstacles to production, 79 percent of respondents said they were affected by restrictions in production activity. At 62 percent, the lack of orders again represents the biggest obstacle to production. Compared to the previous year, this category increased by 18 percentage points. The lack of skilled workers is the second most frequently mentioned category at 45 percent. However, there are no significant changes here compared to the previous year or quarter. The capacity utilisation of the companies surveyed fell by around 6 percentage points year-on-year and, at 74.4 per cent, confirms the difficult order situation.

After a slight increase in June, the expectations of companies in the print and media industry with regard to the future business situation developed much more pessimistically in July. At a seasonally adjusted 91.4 points, the index was around 3.0 per cent below the previous month's level. In a year-on-year comparison, the business outlook index was up by 18.5 per cent and thus clearly above the level of the same month last year, but at the time of comparison companies were in the midst of the energy crisis. This means that the increase can only be attributed to the statistical base effect. With regard to the clouding of economic forecasts and continuing burdens, only a few companies (12 percent) saw a significant improvement in their business situation in the next 6 months. An overwhelming share of respondents (56 percent) expected the situation to remain unchanged, while about 32 percent were pessimistic about the development. At the same time, expectations regarding the development of employment also sank to the lowest point of the year. With a balance of -17.5 percentage points, expectations in July were about 10 percentage points more pessimistic than in the same month last year.